kentucky inheritance tax calculator

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Late Payment and Failure to Withhold or Collect Tax as Required by Law - Two 2 percent of the total tax due for each 30 days or fraction thereof that a payment is late.

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

KRS Chapter 140.

. It must be filed within 18 months of the. Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return Form 706 is not required to be filed. The KRS database was last updated on 10132022.

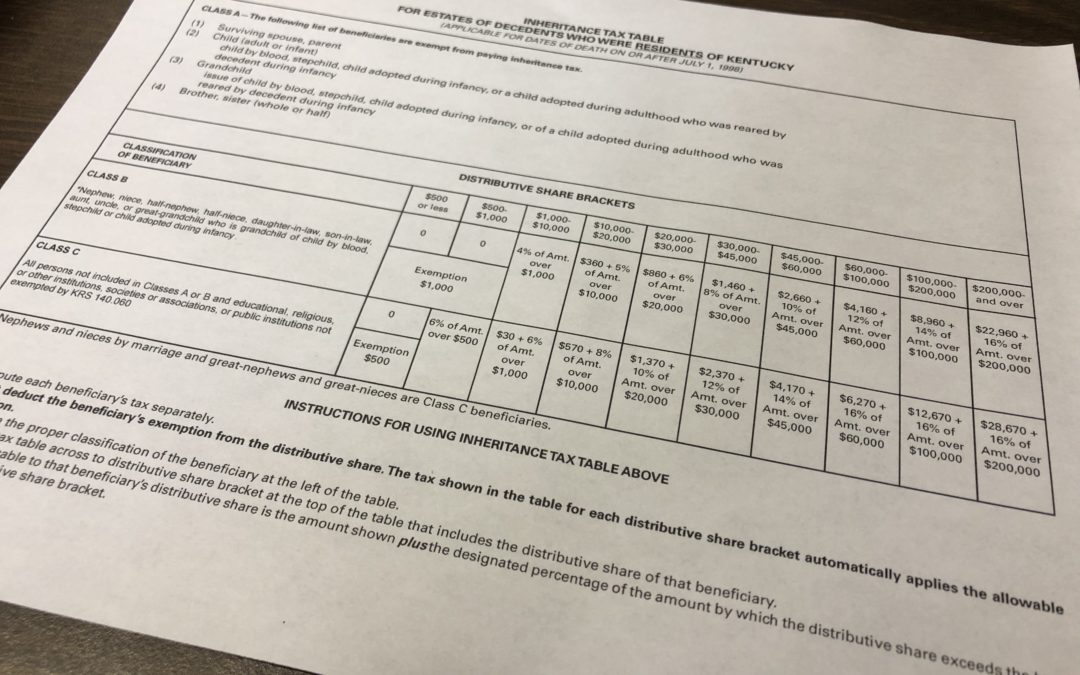

States levy inheritance tax on money and assets after theyre already passed on to a persons heirs. The tax to Class C beneficiaries for gifts of that size is calculated at 28670 plus 16 of the amount over 200000. How much you pay in inheritance tax will depend on your relationship to the deceased.

In Kentucky you need to file an inheritance tax return when you receive an inheritance. This calculator can help you calculate your taxes by breaking down your income into taxable and nontaxable components. Overview of Kentucky Taxes.

These amounts are based on the income tax tables for the state of. There are three options to pay inheritance taxes. The value of the inheritance tax is calculated in consideration of the relationship the beneficiary had with the decedent and the value of the inherited property.

010 Levy of inheritance tax -- Property affected --. The second tax seniors should know about is the Kentucky inheritance tax. If you are a direct relative like.

Pay within nine months of the date of the decdents death to receive a 5 discount Pay within 18 months of the date of the. Kentucky imposes a flat income tax of 5. The inheritance tax is not the same as the estate tax.

The tax rate is the same no matter what filing status you use. This inheritance tax is only levied against the estates of residents and nonresidents who own property in Kentucky. Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent.

Your household income location filing status and number of personal exemptions. Class b beneficiaries are subject to an inheritance tax ranging from 4 to 16 class c beneficiaries are subject to an inheritance tax ranging from 6. The range we have provided in the.

An inheritance tax is a tax paid by a beneficiary when they receive an inheritance. 300 Definitions for KRS 140310 to 140360. Kentucky is a reasonably friendly tax state.

There is no federal inheritance tax in. An inheritance includes money and property. The Kentucky income tax rate is 5 for all personal income.

Annual 2019 Tax Burden 75000yr income Income Tax 3750 Sales Tax 4500 Property Tax 645 Total Estimated Tax Burden. Includes enactments through the 2022 Special Session. Aside from state and federal taxes many Kentucky.

Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return Form 706 is not required to be filed. Kentucky has an inheritance tax ranging from 4 to 16 that varies based on. The inheritance tax in this example is 76670.

Kentucky Paycheck Calculator Smartasset

A Guide To The Federal Estate Tax For 2022 Smartasset

Kentucky Inheritance Tax Fill Online Printable Fillable Blank Pdffiller

Estate Planning Keeping More For Your Family Ppt Video Online Download

Estate Tax In The United States Wikipedia

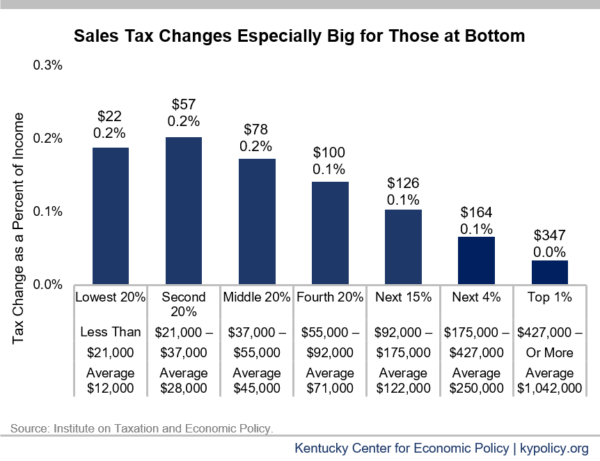

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

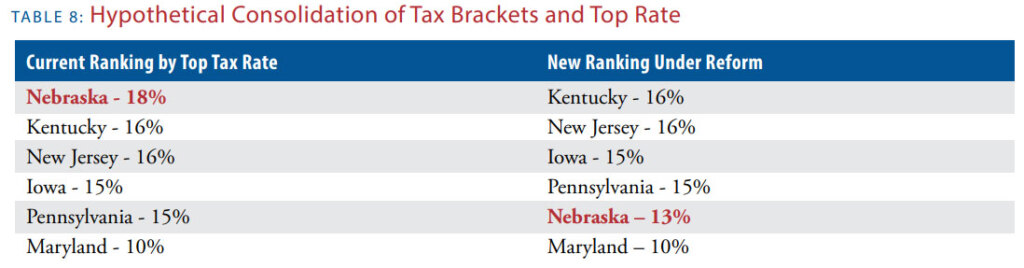

Death And Taxes Nebraska S Inheritance Tax

Michigan Inheritance Tax Explained Rochester Law Center

Inheritance And Estate Taxes Can Impact Ordinary Taxpayers Too

Estate Inheritance And Gift Taxes In Connecticut And Other States

Kentucky S Inheritance Tax Brackney

How Much Is Inheritance Tax Probate Advance

What To Know About Kentucky S Inheritance Tax Crow Estate Planning And Probate Plc

How Much Is Inheritance Tax Community Tax

Death Taxes Definition Limits Calculation Pros Cons How To Avoid It

How To Calculate Inheritance Tax 12 Steps With Pictures

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Inheritance Tax Threshold Rates Calculating How Much You Owe